When it comes to securing a place to live, one of the most important decisions you’ll make is whether to buy or rent. While both options have their pros and cons, there are several compelling reasons why buying a home can be a smarter financial decision in the long run. Let’s dive into the advantages of buying a home over renting, with real-life examples and financial calculations to help illustrate the benefits.

1. Building Equity

When you rent, your monthly rent payment goes to your landlord, and you don’t gain any ownership of the property. On the other hand, when you buy a home, each monthly mortgage payment helps you build equity in the property. Equity is the portion of the home that you truly “own” and is calculated as the difference between the home’s current market value and the remaining mortgage balance.

Example: Let’s say you purchase a home for $400,000 with a 20% down payment ($80,000). You take out a 30-year mortgage for $320,000 at a 4% interest rate. In the first year, a portion of your monthly payment will go towards paying down the principal of the loan and another portion will go towards interest. Assuming an average monthly mortgage payment of around $1,528 (excluding property taxes and insurance), after one year, you might have paid down roughly $5,600 of the principal.

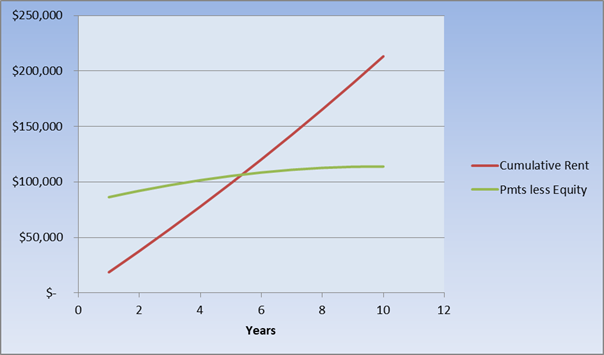

Over time, as you pay down the mortgage, your equity in the home increases. This is money you would have spent on rent but now has a tangible return, building your wealth. Even when taking into account property taxes and insurance, after about 5 years you are financially better off with the home purchase. See the chart below:

The outlays, including the down payment start out really high for the home purchase. But considering the appreciation on the home and the principal that you have paid, your equity begins to more than offset the cumulative cost of your payment.

2. Potential for Property Appreciation

Real estate tends to appreciate over time, especially in desirable locations. If your home’s value increases, you stand to benefit from this appreciation when you decide to sell the property. This is another one of the key advantages of buying a home.

Example: Imagine you buy a home for $400,000, and over the next 5 years, the property appreciates at an average annual rate of 3%. After 5 years, the home’s value could increase to approximately $463,710 ($400,000 * (1 + 0.03)^5). If you sell the house at that time, you stand to make a profit of $63,710 (minus transaction costs). This gain is something that renters don’t have the opportunity to experience.

3. Tax Benefits

Homeowners can take advantage of various tax deductions that renters cannot. For example, the interest paid on your mortgage can often be deducted from your taxable income. Property taxes may also be deductible in some cases.

Example: Suppose you have a mortgage of $320,000 at 4% interest. In the first year, your total interest payment would be around $13,000 (calculated roughly using an amortization schedule). If you’re in the 25% federal tax bracket, this interest deduction could save you $3,250 on your taxes ($13,000 * 0.25). This is a significant financial advantage over renting, where you don’t have the opportunity to deduct anything from your taxes. Note that you must be itemizing deductions for this to be applicable.

4. Stability of Monthly Payments

Rent can increase over time, especially in competitive rental markets. On the other hand, with a fixed-rate mortgage, your monthly payment remains stable for the entire loan term (usually 15 or 30 years). This can offer significant financial predictability and security.

Example: If you sign a lease for a rental property at $1,500 per month, there’s a good chance your rent could increase in a year or two, depending on market conditions. However, if you buy a home with a fixed-rate mortgage at $1,500 per month, that payment won’t change. This stability can be especially valuable during times of inflation or rising housing demand.

5. Freedom to Personalize Your Home

As a homeowner, you have the freedom to make changes and improvements to your property without needing approval from a landlord. Whether you want to renovate the kitchen, add a deck, or paint the walls any color you choose, the home is yours to modify as you see fit.

Example: Let’s say you want to upgrade your kitchen by installing new countertops, cabinets, and appliances. As a homeowner, you can invest in improvements that add value to your property, potentially increasing its resale value. If you decide to sell the home in the future, these renovations may pay off. Renters, on the other hand, often face restrictions on making changes to a rental property.

6. Long-Term Cost Benefits

Although buying a home typically requires a larger upfront investment (such as a down payment and closing costs), over the long term, it can be more cost-effective than renting, especially if you stay in the home for an extended period.

Conclusion

While renting a home can offer flexibility and fewer responsibilities in the short term, the advantages of buying a home offers significant financial benefits that make it a great long-term investment. With the ability to build equity, take advantage of tax benefits, and potentially profit from property appreciation, owning a home provides numerous opportunities to build wealth. Additionally, the stability of fixed monthly payments and the freedom to personalize your space are key benefits that renters simply don’t have.

Ultimately, buying a home may require more upfront investment, but over time, it often proves to be a wise financial decision. It’s important to consider your personal circumstances, financial readiness, and long-term plans before making the decision to buy. But for those who are prepared, homeownership offers a unique chance to invest in your future.

Leave a Reply

You must be logged in to post a comment.